Raglan.net

The two chalked messages made a dramatic change from the usual seabed mining signs. “Fabulous result KASM thankx” read the Raglan West roadside blackboard that usually advertises scooters for hire, while proudly graffitied on Whaingaroa Environment Centre’s front wall was a simple “We won!” with “No seabed mining” in smaller lettering above.

In what its chairman Phil McCabe described as an “amazing” result, Raglan-based KASM last week won the David-and-Goliath fight to prevent foreign giant Trans-Tasman Resources mining ironsands off the Taranaki coast.

“It spun me out,” Phil admitted of the text message he received Wednesday a week ago saying simply “TTR application denied”. And he reckoned Whale Bay environmentalist Malibu Hamilton “nearly fell off his chair” when he relayed the news on to him.

Phil had only ever believed KASM had a 50:50 chance of success.

The rejection by an Environmental Protection Agency-appointed independent panel, of TTR’s application to take many millions of tonnes of ironsand from a 66 square kilometre area off Patea came, after months of hearings around the country.

The panel said its major reason for refusing consent was the uncertainty around the scope and significance of potential environmental effects.

When the Chronicle caught up with Phil last Friday he was still euphoric at the collective effort of the Raglan community to fight seabed mining.

“It’s been a huge effort from Raglan,” he said of KASM’s 10 year battle, the last two years of which have been focused on the TTR threat. “And we have so many people from the original crew still all there. Every single KASM action over the years has contributed to this success.”

He said the rejection of TTR’s application had given environmentalists like himself a sense of hope, and had set a global precedent against sand mining’s threat to the world’s oceans.

The EPA panel’s ruling was not only a just decision, Phil told the Chronicle, but a bold and courageous one, given it went against the residing Government policy. There was no doubt National wanted ironsand mining to happen, he said.

“If you’d looked at the information provided (by KASM to the hearings) you’d say yes, deny TTR, but if you thought about the Government agenda then of course the political pressure would make the decision go TTR’s way.”

That’s why the text from a supporter down-country – the one saying “TTR application denied” – came as such a surprise last week to KASM committee members, who gathered at Solscape eco retreat soon after for a celebration which captured media attention.

Phil said KASM’s fight against TTR – from rallies and silent protests in the street to fundraising for legal costs of up to $30,000 – had been all-encompassing.

And for him personally it meant being “fully immersed” in the politics of the sand mining issue like never before, particularly back in March and April with hearings running for six weeks in Wellington as well as for a week in both Taranaki and Hamilton.

But it had all been worthwhile to get the message across that coastal communities didn’t want exploitive development of the TTR sort to fill the wallets of wealthy shareholders offshore. “We may have the technological ability to mine the ocean but we don’t have an understanding of the environmental impact,” he added.

Phil said the KASM committee was now turning its attention to an application to mine phosphate nodules over a much bigger area on the Chatham Rise, about 450km offshore from Christchurch.

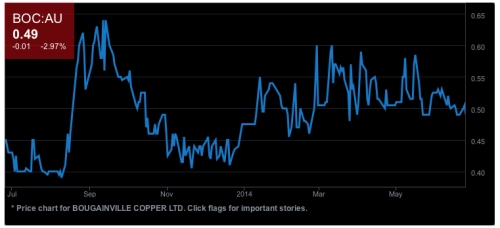

The decision to turn down TTR’s application showed companies just how risky it was to invest in this sector, he said, noting that shares owned by investors in the Chatham Rise venture fell 20 percent once the South Taranaki result was announced.

“This decision provides a pivot point for realignment of the compass to direct investment (in New Zealand) into more appropriate development,” he added of the estimated $60 million spent by TTR over six or seven years to get its application accepted.

There was no shortage of iron ore in the world, he said, and it could be mined with far less (detrimental) effect elsewhere.

TTR had 15 days to lodge an appeal in the High Court, which can only be made on points of law.